Advisory Services

As a result of our executive management, institutional banking and corporate advisory experience, we have the skills and relationships to assist businesses to identify and access strategic alliances, commercial opportunities, financial solutions, and capital investment that might not otherwise be available to them.

Strategic services are aimed at business growth and exit, business turnaround, and wholesale financial solutions.

Our core advisory services include:

- functional reviews – 360 degree review of financial performance and operations to identify issues and inefficiencies that may not be discoverable via financial analysis alone;

- business development – optimize product and service offering, and distribution channels and processes, and introduce related commercial relationships;

- organisational re-architecture – optimize business structure, culture, systems, processes, and supply chain, to ensure efficient delivery of products and services;

- financial structuring– design debt, equity, lease, and capital strategies for capital markets, project, property, asset, acquisition financings, and corporate restructures;

- risk management – design and implement risk management solutions for foreign exchange, interest rate, credit, asset, and operational exposures;

- project management – initiating, planning, and managing all commercial, financial, legal, and resourcing elements related to the implementation of business initiatives; and

- strategic advice – combination of above services as enhanced by organic and inorganic vertical, horizontal and geographic expansion strategies, and documented in budgeted business plans

taking into account:

- stakeholder goals, requirements and limitations;

- market, industry and political trends and consequences; and

- operational and financial infrastructure requirement.

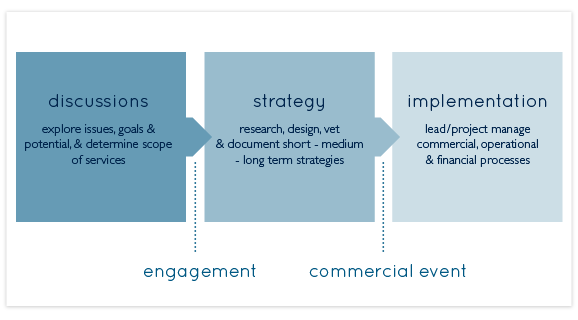

PHiQ’s advisory services are provided via our Strategic Services, Business Improvement, Investment & Sale Readiness, and Financial Services offerings. The ideal outcome of which is to convert advisory clients into principal investments.